Twitch’s

Rockonomics

Live streaming won’t go away when live music returns. This inquiry into Twitch helps us understand how they may co-exist.

About the Author

Will Page is the author of the critically acclaimed book Tarzan Economics, now translated into five languages and due out in paperback in January 2023. As the former Chief Economist of Spotify and PRS for Music he pioneered Rockonomics. At PRS he published work on Radiohead’s In Rainbows and saved BBC 6Music. At Spotify he uncovered the anatomy of a hit and articulated the global value of music copyright. A passionate communicator, Will’s is a regularly contributor to the Financial Times, Billboard and The Economist. Will's first break into music was penning articles for Straight no Chaser magazine, and his DJ sets continue to top the global charts on MixCloud. He co-presents the Bubble Trouble podcast and is a fellow at the London School of Economics, Edinburgh Futures Institute and the Royal Society of the Arts.

You can view Will’s speaking reel here.

‘If you keep the full $100 of each true fan, then you need only 1,000 of them to earn $100,000 per year.’

Kevin Kelly, The Technium, 2008

Kevin Kelly’s 2008 1000 True Fans essay is making something of a comeback, as many artists today are feeling short-changed from their paltry music streaming royalties. In a recent Harvard Business Review article that’s rich in media theory, Li Jin argues that ‘The Creator Economy Needs a Middle Class’. Jin encourages us to rethink media, and Kelly’s essay suggests a remedy, which Twitch is strongly positioned to provide.

Twitch offers a unique way for artists to reach fans and earn money. The growing criticism from music industry trade bodies about Twitch’s licensing strategy appears to be based on a misunderstanding of what Twitch is and isn’t – which is understandable, given that live streaming on Twitch is a new paradigm. Key to this seachange are Twitch’s roots in the culture of gaming. You can bring a horse to water, or you can bring water to the horse. Twitch is bringing music to gaming.

That takes us to the threefold objective of this inquiry. Getting exclusive access to data (and data scientists) from Twitch, MRC Data and ChartMetric has allowed me to:

(i) establish what makes Twitch distinct;

(ii) enable the music industry to compare Twitch with on-demand streaming models to better understand the different ways creators can make money; and

(iii) illustrate how Twitch works, using six unique artist case studies.

This work is timely, as live music – the breadwinner for most artists – has been silenced during the pandemic. We don’t know what a new normal will look like, but we do know that live streaming won’t go away when live music returns. Understanding Twitch will help to understand how they may co-exist.

Part 1

Twitch Distinctions—

It’s almost 20 years since the 2002 launch of Rhapsody, among the first music streaming services, at the same monthly price of $9.99 that we see today, and fans remain largely disconnected from their favourite bands. None of the on-demand streaming services that have since sprung up enable immediate engagement, nor do they offer fans a way to directly compensate creators. This is a relic of the music industry of old.

So is the remarkable similarity across all the major music streaming services. Not only do they charge the same monthly fee, but they offer the same 60 million songs. This makes ‘cross-usage’ – where a subscriber to one streaming service would also subscribe to another – irrational. MusicWatch, a consultancy, reckons only a quarter of those who pay for one music service also pay for another, and it’s probably lower as some of them will be in the process of churning or switching. This is in stark contrast to video streaming, where exclusive content fosters cross-usage: a consumer paying for Hulu, Disney+ or HBO Max is more likely to pay for Netflix. ReelGood data puts this cross-usage figure as high as 90% – making Netflix a universal service. Not only are these services additives, but each has been raising its price gradually in recent years.

Popular Subscription Streaming Service Combinations in the U.S.

Change has been a long time coming. Many companies like TopSpin and MySpace tried to remove this price ceiling and enable direct artist-to-fan relationships, but found themselves left by the internet’s wayside – or being fondly remembered as ‘My Empty Space’. Twitch brings a long-overdue change. Artists are now able to build atop the old service models, adding a new lane that goes ‘over the top’ of the traditional streaming model and monetises their own channels instead. The best way to understand this change is to focus on what makes Twitch distinct. The table below summarises Twitch’s unique position among digital music platforms by focusing on four characteristics: (i) the user experience; (ii) the licensing framework; (iii) money in; and (iv) money out.

What Makes Music on Twitch Distinct

User Experience

Twitch usage is primarily via laptop/desktop, rather than the mobile app-based use that dominates nearly all other online experiences. Unlike most other services, Twitch is predominantly used for live streamed content. And despite conventional wisdom holding that the sweet spot for consumption is under 30 minutes, typical Twitch usage is very long-form.

A reliance on the desktop may feel like a disadvantage in a ‘mobile first’ world of smartphones, but the opportunity for the desktop-first strategy is that it competes for attention in a space where many other media companies have taken their eye off the ball. The war for attention taking place on our smartphones resembles a tragedy of the commons: seemingly innumerable competing apps are over-exploiting our scarce attention, with little regard for the actions of others. The desktop is arguably less susceptible to this insatiable competition for our attention, as people using a desktop are typically in a more focused zone than when they’re on their phone. Win this form of attention and you win subscribers, not just ad dollars.

MIDIA, a consultancy, recently studied the average weekly hours spent at each of these four ‘venues’ per user. YouTube, TikTok and Spotify may have more users than Twitch, but Twitch users reportedly spend almost three times as much time (16 hours) as on Spotify and YouTube. This should not be surprising given Twitch’s roots in gaming, which typically involves long durations of dedicated attention. For example, when the game Animal Crossing launched during lockdown, the average duration of playtime was over nine hours!

Weekly Hours per Weekly Average User

Music has won its battle against piracy thanks to the convenience of streaming, but it risks losing the war for attention if its lean-back nature is marginalised by more lean-forward forms of activity. As David Bowie famously put it almost two decades ago, ‘music itself is going to become like running water’, i.e. always there, always in the background. By bringing music to gaming, and especially by bringing the lean-in experience of live streaming to the less contestable desktop venue as Twitch does, music may well find a new way to capture attention that it would otherwise lose.

Music Licensing Framework

Most online on-demand services use a rightsholder licensing system, wherein the service obtains sound-recording rights from record labels and publishing rights from publishers and Collective Management Organisations (CMOs). Twitch, conversely, orients itself directly toward musicians or performers.

Twitch is distinct here in that the creator is both the source of content and the licence provider. Many musicians live streaming or uploading content control the sound-recording rights (simply because they create that sound during that live stream) and may also control the publishing rights in their underlying compositions. The one notable exception is ‘Performing Rights’, which need to be granted in case a Twitch artist performs a cover version of a CMO-controlled song.

The traditional solution that enables artists to perform cover songs is ‘blanket licensing’. In this system, national CMOs permit performances of any song in their catalogue to every physical venue, outdoor festival, radio/TV station and online service in their territory. Because the vast majority of songwriters (>99% in many countries) join their national CMO (so that the CMO controls their ‘Performing Rights’), this system allows venues/services to ‘perform’ (i.e. broadcast/transmit) effectively any song ever written. It is therefore necessary to obtain a blanket licence for ‘Performing Rights’ in each country where it is available. Even though this doesn’t apply where an artist is not a member of a CMO and performs only self-penned songs (or is a member of a US-based CMO and is able to grant a ‘direct licence’), the blanket licences are still necessary for performances of all other songs in each country. Unfortunately for Twitch (and other video services), there is no blanket system for ‘sync’ licences (which must be obtained on a song-by-song basis whenever a song is used within a video recording).

Lastly, (for the avoidance of doubt) there is no copyright problem involving record labels (for live artist performances, because there is no record) though there may be contractual restrictions or monetary claims from a label if the artist has signed a ‘360’ or similar record deal that includes a right to live income.

Money In

Most music streaming platforms have only two possible revenue sources: advertising and subscription. Some merge both sources into a freemium approach – where the ad-funded tier acts as a funnel to drive conversion into the premium tier. Accordingly, any ‘Money In’ model that strays from these sources – as Twitch’s does – presents a challenge to the music business, and a learning curve for creators and consumers. To help bring some clarification, Twitch brings in money in three ways:

1. Creator Channel Subscriptions

Creators earn a share from subscriptions to their channel, which can cost $4.99, $9.99 or $24.99. They also earn money when users gift subscriptions to friends or activate their free Prime Gaming subscription.

2. Bits

Bits allow users to support creators directly on the service.

3. Ads

Creators earn from advertising on their channel and can determine the length and frequency of mid-roll advertisements through their dashboard.

Some Twitch creators also choose to earn money via third-party platforms to which they direct fans from their Twitch channels. These include PayPal, Patreon and StreamLabs (which supports Twitch artists with its own encoder and does its own payment processing). All of these examples constitute ‘over the top’ attributes of Twitch not found in conventional music streaming services.

Money Out

To date, the typical music streaming model has approached the money out question with a pro-rata answer. Put simply: the platform aggregates all the streaming data and revenues from a specific market and product over a specific time period, divides an artist’s share by that sum, and allocates revenues proportionately. Get 1% of all the streams, and you’ll get 1% of all the money. This has spurred much debate within the industry, as heavy streamers are effectively subsidised by light streamers, or as Quartz controversially put it: Your Spotify and Apple Music subscriptions pay artists you never listen to.

An alternative to pro-rata distribution is ‘user centric’ – where each subscriber’s monthly fee is ring-fenced to their own listening. The ethics of ‘my money, my music’ are attractive, but the cost and complexity of its implementation – linking millions of artists directly with hundreds of millions of consumers – has made it unworkable to date. Yet, almost by coincidence, Twitch offers this highly sought-after ‘user centric’ solution via its channel subscriptions – if you pay a recurring fee to a creator's channel, they’ll see that revenue without any of the pooling inherent to the pro-rata model.

With Twitch, it’s not just a straight line between creator and consumer, but it’s a fast line as well. Twitch raises the bar in terms of the speed by which the money gets out – committing to payment within 30 days after the month ends. Generated a significant amount of revenue in April? See it in your bank account by the end of May. For conventional music streaming platforms, the time lag artists experience is typically 6-8 months. For songwriters it’s even worse. If a PRO distributes semi-annually and takes more than 12 months to process the data, then the delay to getting money out can be measured in years.

Twitch has built an impressive reputation for ‘straight line’ payments to creators – something most other platforms have yet to replicate. The traditional ‘pro-rata’ model is rife with problems and creators are looking for a better way. Almost by accident, Twitch’s model of monetising channels delivers it.

Part 2

Twitch True Fans—

Now that we’ve established what Twitch is and isn’t, we need to go a step further to translate how its monetisation works.

This will involve comparing apples with pears: on one hand, the payment-per-stream model associated with music streaming services and, on the other, the channel-monetisation model on Twitch. It is tempting to compare Twitch to driving a taxi – if you ain’t on the road (or live streaming), the meter ain’t moving. There’s some truth to that analogy, but it doesn't capture that once you establish a relationship, there’s no longer a contractual rate. The longer and deeper the artist-fan relationship, the more generous the fan and likelier they will pay extra to gain status within the community. Put simply, once a loyal base of fans are used to riding that taxi, Twitch creators can monetise them many multiples over.

In this section we’ll break down the hard math of Twitch monetisation; consider it a main course, before we go to our artist case studies for dessert.

The status quo of streaming

Analysts discussing the economics of music streaming often reference a hypothetical half-cent per stream rate, but this is merely a crude top-line ‘gross’ figure – it fails to appreciate what trickles down to the creator.

To get to the ‘net’, the ‘fifth-of-a-fifth rule’ kicks in. That is, if a band earns a 20% royalty, and there are four members in the band plus a manager, then each member will see one-fifth of one-fifth of that half-cent per stream. If a million streams gross $5,000, then one-fifth of that gross sum ($1,000) needs to be split five ways, giving each participant a pre-tax income from those million streams of just $200.

Comparing streaming-apples with Twitch-pears

This inquiry was fortunate to have the collaboration of Twitch, MRC Data and ChartMetric, resulting in data analysis that’s never been made possible before. More importantly, we had the blessing of the artists themselves who saw the educational value of this work. Twitch provided a full suite of analytics across the studied artists, and even constructed new metrics to make this report shine. MRC Data contributed US and Global monthly streams across audio and video formats, enabling a look at America’s share of the global market for both Twitch and music streaming. And ChartMetric pulled monthly social reach figures across leading music and social platforms. To compare creator earnings on Twitch with that of global streaming, the per-stream rate used in the following model is set at $0.003. Whilst an estimate, it factors in the global data (which tend to have a lower rate than in the US) as well as the presence of video (which are typically lower rates than audio). The table below sets out the basics of the modelling exercise, which allows for comparing streaming apples with Twitch’s pears.

Modelling the Rockonomics of Twitch

Twitch’s monetisation approach offers scope to creators, but to understand why requires a bit more complexity than understanding the arithmetic behind the per stream metric. To tackle this, consider the two-axis chart below – which aggregates the six artists whose case studies we’ll explore later – in terms of demand and supply. The left side shows the results of fans’ demand, measured by average payment per hour watched.

Hovering around 15 cents, this number represents the average income artists receive from each hour that one fan spends watching their channel. The right side reflects the results of the artist’s supply: for each hour spent broadcasting, how much revenue does that generate? This is akin to an hourly rate which, in this example, works out to around $100.

Twitch Creator Revenue Trends

Once we appreciate how demand and supply interact on Twitch, exploring their dynamics proves illuminating as to the future of live streaming. Established artists who move a large fan base onto Twitch may take several months to get traction in monetisation, resulting in initial downward pressure on demand, captured in the red line. Similarly, if lockdown has simply replaced hours spent touring with hours live streaming, then this could distort the purple bars on the supply side. For example, there could be ‘crowding in’ effects (wherein consumers swarm to Twitch during lockdown to witness a small pool of creators) and ‘crowding out’ effects (wherein creators swarm to Twitch but can’t find the consumers). The point is that too much or too little activity on the service could distort the output of the purple bars.

Then there is the variance in the revenue-per-hour-watched, where we take the red line above and plot the spread for the six artists in the chart below. Within this six-artist data set, newly launched channels saw their revenue-per-hour-watched hover close to zero, (the part of the red bars that touch the x-axis) as fans and creators figured out monetization. Established channels that have had more time to generate traction can see revenue per hour north of 25 cents, with some scaling up to 75 cents (see September 2020).

Twitch Creator Revenue/Hours Watched, Low and High Range

Contrast this with the ‘money out’ of pro-rata, assuming a relatively stable value of a stream, which for the purpose of this modelling work is set at $0.003 across all global audio and video platforms. A crude comparison can be drawn: taking the $0.003 per stream and multiplying by 17 to soak up an hour of listening on the clock (assuming a song lasts just over three minutes), then applying a 20% royalty, equates to a creator’s revenue-per-hour listened of just $0.01 – less than a tenth of the $0.15 per-hour-per-user on Twitch.

Targeting ‘True Fans’

Although Twitch can monetise over 10 times better than music streaming, this will only apply to creators’ most loyal ‘true’ fans. Let’s put some hypothetical numbers behind this: if one-tenth of your streaming audience is made up of ‘true fans’ and Twitch monetises them ten times better, then getting those ‘true fans’ to engage with Twitch means you make the same from those few as you do from the many on streaming. To precede the six-artist case studies forthcoming, the chart below shows real-world numbers that answer a similar question: ‘What percentage of my current streaming audience do I need to also engage on Twitch to make the same as I do on streaming?’

In the case of Matt Heafy, whom you’ll read more about shortly, this simplistic example is brought to life. He’s got roughly 2.5m fans on streaming and around 250,000 on Twitch, yet as we’ll learn from his forthcoming case study, his income is broadly the same from each. Although the noise involved with this data makes its interpretation a bit fuzzy, the evidence clearly suggests that artists can double their revenues by engaging a relatively small percentage of their fans on Twitch.

Twitch Audience Equivalent as % of Music Streaming Audience

Part 3

Twitch in Action—

The following case studies draw upon the expertise of data scientists at Twitch, product teams at MRC Data and commercial teams at Chartmetric.

This collaboration enables a view into how the Twitch model allows creators to make money from their work, and also the spillover impacts from their activity on the wider music and social media ecosystem. This holistic view illuminates the ‘order of events’ – does Twitch lead then streaming and socials follow, or is it the other way around?

These unique artist portraits have been organised into two groups: ‘Inside Out’ explores three artists who have established themselves on Twitch and are now scaling beyond it; ‘Outside In’ examines three established artists who have come to Twitch to develop a new form of engagement and monetise new content.

Inside, Out:

Artists Who’ve Launched a Career on Twitch

Laura Shigihara

Laura Shigihara is one of the most well-known composers in the video game industry, having created soundtracks for games that have sold hundreds of millions of copies worldwide (including Plants vs. Zombies and World of Warcraft). She also created an entire game, Rakuen, one of the highest ranked games of all time on Steam.

Laura's career took off in Japan, where she was offered recording and publishing contracts by major labels, but turned them down and pursued her career in the video game industry. Now, as she brings her audience back to Twitch, it's like her career has come full circle as she gets back to her roots as a performer. Twitch is a natural intersection to take this developer-composer-performer career to its next logical step as her audience is naturally aligned with her creativity. Indeed, many prominent Twitch streamers have covered her music (e.g. lilypichu, natsumii to name a few).

To put her success on Twitch into context, Laura’s audience (across audio and video streaming) peaked in Spring 2020 at around 150,000 listeners; yet by autumn she was regularly reaching more than 200,000 viewers on Twitch. From quantity to quality, although Laura was getting five times more engagement (monthly consumption hours) on audio and video streaming, she was earning 10 times more revenue on Twitch, as it allowed her fans to give her more direct and effective support (see chart). And none of this has decreased Laura’s YouTube or Spotify following, both of which have steadily increased over the same period.

Creator Net Revenue, Global

‘Although Laura was getting five times more engagement (monthly consumption hours) on audio and video streaming, she was earning 10 times more revenue on Twitch, as it allowed her fans to give her more direct and effective support.’

Aeseaes

‘Aeseaes’ are Travis and Allie, a married couple and acoustic duo from Austin, Texas, quit their 9-to-5 living to make live streaming pay. They refer to their journey as a ‘magical DIY adventure’, and this intimate expression neatly captures the aesthetic they create with their virtual fireside chats (or jams) they broadcast live on Twitch twice-weekly, tinged with soft lighting, intimate camera angles and acoustic instruments.

Allie leads on vocals and plays guitar in the foreground, while Travis usually accompanies her with bass, upright bass, or any other available four-string instrument from the background. Their cat, which has its own small screen, may be the secret to their success, especially amongst the children of the parents subscribing to their channel: ‘came for the music, stayed for the cat’ is a rather common chatter sentiment.

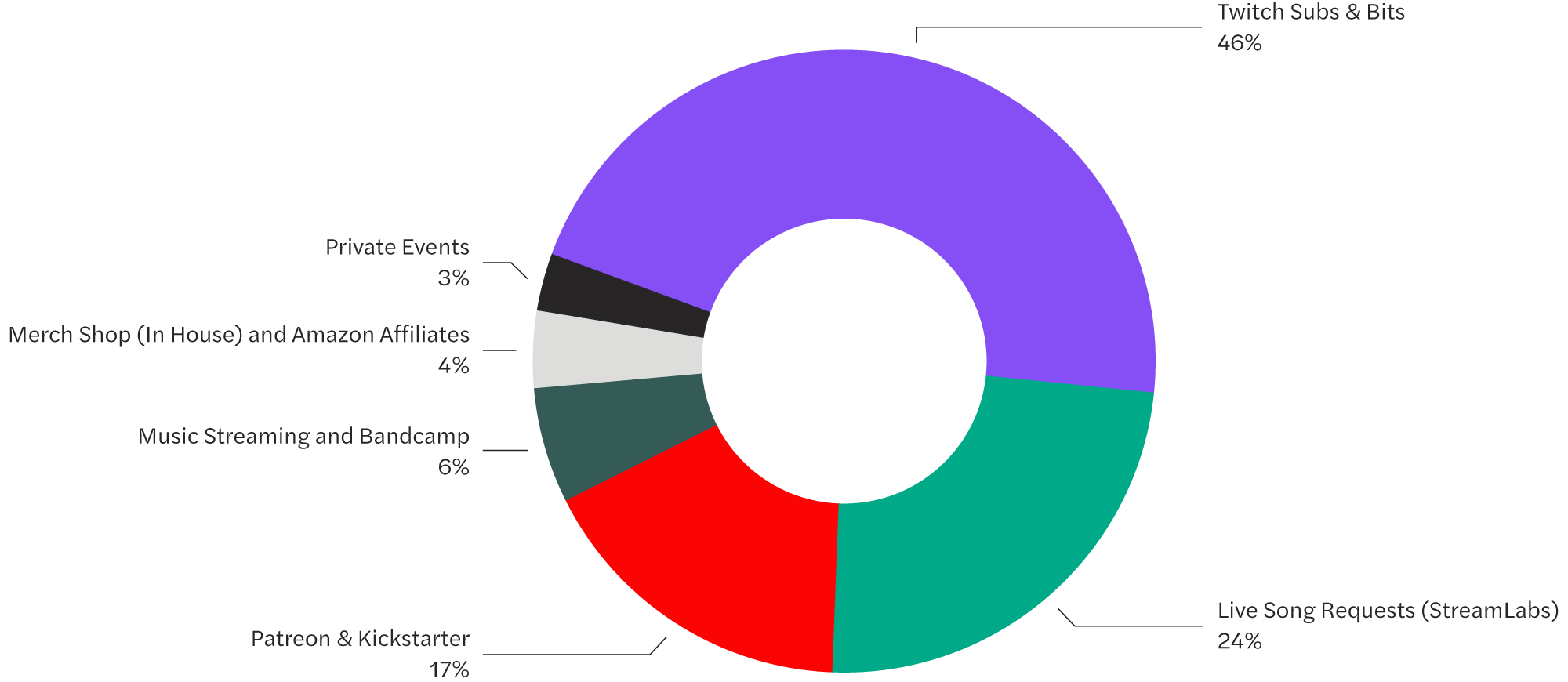

Their commitment (and their cat) seems to be paying off: they now rank as one of the most successful music channels on Twitch. Aeseaes reach audiences of 40,000 unique fans a month with occasional event-driven spikes taking them to a quarter of a million. They are soaking up 30,000 attentive hours a month, which is high by any standard. And they are monetising those hours with an impressive array of creator-tool-weaponry successfully deployed on the Twitch service to generate revenues from their work. The donut chart below clusters all of these tools into six revenue buckets across the past two years: (i) Twitch subscribers; (ii) Live Song Requests (StreamLabs); (iii) Private Events; (iv) Music Streaming and Bandcamp; (v) Patreon and Kickstarter; and finally (vi) Merch Shop and Amazon Affiliates.

Aeseaes Creator Earnings by Source 2019-20

The chart tells a remarkable story: put together, Twitch and StreamLabs – which they use to monetise paid requests from their fans – make up 70% of all earnings over the past two years. Patreon (geared towards supporting their cover songs) and Kickstarter (which raises funds for original compositions) work hand-in-hand – complementing, not competing, for ‘true fan’ support. Revenue from streaming, bandcamp and merchandise are only 10% but growing steadily with the recent release of their full length album, and this year saw the launch of their homemade microphones which will drive sales further. Finally, and perhaps unsurprisingly, private events made up only 3% of revenues over the past two years but as lockdown eases and touring returns, this could easily grow to match current earnings from Twitch – adding, not taking away, from their impressive portfolio.

Aeseaes are putting into practice what too many blogs just talk about in theory – maximising the potential of all creator tools that are out there to allow them to live off their work; tools that artists too often overlook today, especially when they cede control to an intermediary.

‘Aeseaes reach audiences of 40,000 unique fans a month with occasional event-driven spikes taking them to a quarter of a million. They are soaking up 30,000 attentive hours a month, which is high by any standard.’

Sereda

Los Angeles-based Sereda has been on a journey that far too many artists can relate to: spending years trying to make it in the music industry and getting nowhere. Close to quitting, she was introduced to Twitch. Thanks to a combination of putting serious hours into her channel and the experimental freedom of trial and error she built out a novel idea of monetising her songwriting process just as gamers monetise their channels. Sereda now streams her songwriting process three to seven hours per day, taking feedback from fans in real time. Her opportunity cost was a fat zero, as she pointed out: ‘I was always in here, in my room, making my music anyway’.

In a recent article in the CNBC Grow Acorns website, Sereda emphasised her independence: ‘The support that I have received from people who have come to find my channel on Twitch is something I’ve never experienced.’

She went on to explain, ‘Here I am, an independent artist with no record label, no publishing deal, no manager, no help from anybody, literally just me and this platform, Twitch’. That self-sufficient route has seen her Twitch follower count reach the quarter-of-a-million mark. She’s also worked with local sync licensing teams to secure placements – most notably gaming, as one of her songs was picked up for a PlayStation 5 commercial.

Sereda also offers us a ‘smoke signal’ for how live streaming might co-exist with the return of live music. She’s recently completed three separate virtual live ‘tours’ on Twitch, which involve about a three hour show every night viewed by over 100,000 people every day. At the turn of the year, she noted that her last show ‘had 1.5 million tune in and shifted 2,800 copies of her latest album Surrender the Word’. Sereda plans to continue these virtual shows after lockdown is over and is adamant she’s established how to monetise them even better than in real life – a timely reminder of how lockdown has made us revisit the opportunity cost of our pre-pandemic actions.

As the chart here shows, Sereda’s channel draws an audience of around 400,000 – but she has yet to make serious inroads onto other platforms. There are signs that she is now travelling inside out, however. Back in 2019, Sereda’s followers on Spotify rose from just 1,000 in November to 6,000 today, and her streams have jumped from 30,000 to 200,000 over the same period – a clear sign of Twitch being additive to streaming elsewhere. On YouTube, she sits at 10,000 followers, and she’s added a tenth of that in the past month alone. Her socials indicate a similar climb, with Instagram doubling to 40,000 in the past year and since engaging with TikTok, her work there has notched up a following of 80,000 in just a matter of months. For Sereda, it looks like a rising tide lifts all boats.

Active Audience, Global

“Here I am, an independent artist with no record label, no publishing deal, no manager, no help from anybody, literally just me and this platform, Twitch.”

Outside In:

Established Acts Bringing ‘True Fans’ to Twitch

Matt Heafy

Matt Heafy is the vocalist and guitarist of the Grammy-nominated American heavy metal band Trivium, who've released 10 successful albums and established audiences in North and South America and across Europe. Heafy is almost entirely self-taught, made his first recordings when he was 16 and Trivium is the only job he’s ever had.

His ‘outside in’ journey to Twitch has seen him become one of the most consistent and active music streamers on the service, grinding it out two times a day, five days a week. Heafy writes and performs his latest solo work, and on-boards his entire band to share special moments with fans. In the illuminating Forbes article ‘Trivium’s Matt Heafy Details New Album And How Twitch Has Changed His Career’ he fleshed out how Twitch works:

‘[...] So lo and behold, I’ve only had one job ever, it’s been Trivium, first band, first job, but for the last three years I’m happy to say Twitch has become a second job. When I’m at home I make significantly more from Twitch streaming than I do with Trivium, and then when I’m out on tour with Trivium then obviously Trivium becomes more and Twitch becomes less. But the fact that I’m able to make money doing what I should be doing off tour, staying conditioned, practicing, and being ready for a tour at any given moment, it’s amazing and we really have a supportive community…’

The Creator Net Revenue chart here shows how the money Heafy sees from Twitch is broadly equal to the money his band sees on music streaming. As mentioned earlier, he’s achieved this despite his engaged audience on Twitch being just over a tenth of the size of what he reaches on music streaming services. It's tempting to ask what happens when the band goes back on tour, as ticketing and merch revenue from a typical tour would likely exceed $4m, but that’s why Heafy’s remarks are so persuasive: firstly, he can’t tour these days; and secondly, even when he can, he needs to stay ‘conditioned, practicing, and being ready’ anyway – meaning Twitch is adding to both his artistic and monetary base.

Creator Net Revenue, Global

“The fact that I’m able to make money doing what I should be doing off tour, staying conditioned, practicing, and being ready for a tour at any given moment, it’s amazing.”

mxmtoon

California Bay Area singer-songwriter mxmtoon has, since her early teens, been consistently setting new standards for what an artist can be. At just 13, going by her first name Maia, mxmtoon began posting videos online about her travel experiences, everyday life, and songs she was writing.

Her fan base expanded in 2017 with her single Falling for U and a compilation of singles on her plum blossom EP. For someone so young and independent, she is also remarkably prolific. Extensive scrolling of her Spotify page reveals over 55 album tracks and three separate EP projects – the most recent being an intimate cover of Radiohead’s timeless classic Creep.

mxmtoon is an artist who has not only grown through social media, but who’s scaled her audience through lockdown. She has five million monthly listeners on Spotify along with a daily podcast and a Carly Rae Jepsen collaboration to her name. She boasts six million listeners on Spotify, 2.4 million followers on TikTok, almost 0.9m on Instagram, and 0.5m on Twitter. Since March 2020 she’s been engaging with Twitch and by the end of the year amassed an audience of almost a quarter of a million, to whom she streams herself writing songs live as well as gaming.

The chart here shows all her key social metrics are rising and the more engagement she gets across all platforms – Twitch included – the more they rise. Her gains resemble ‘compounded growth’ – where each stage of viral growth is building on what went before it. On Instagram, for instance, it took three years to the start of 2020 to double her reach, and now in early 2021 she’s doubled it again. Soon she’ll pass a million, and before long it’ll likely be two million.

Social Reach (Followers/YT Subs), Global

‘All mxmtoon’s key social metrics are rising and the more engagement she gets across all platforms – Twitch included – the more they rise.’

RAC

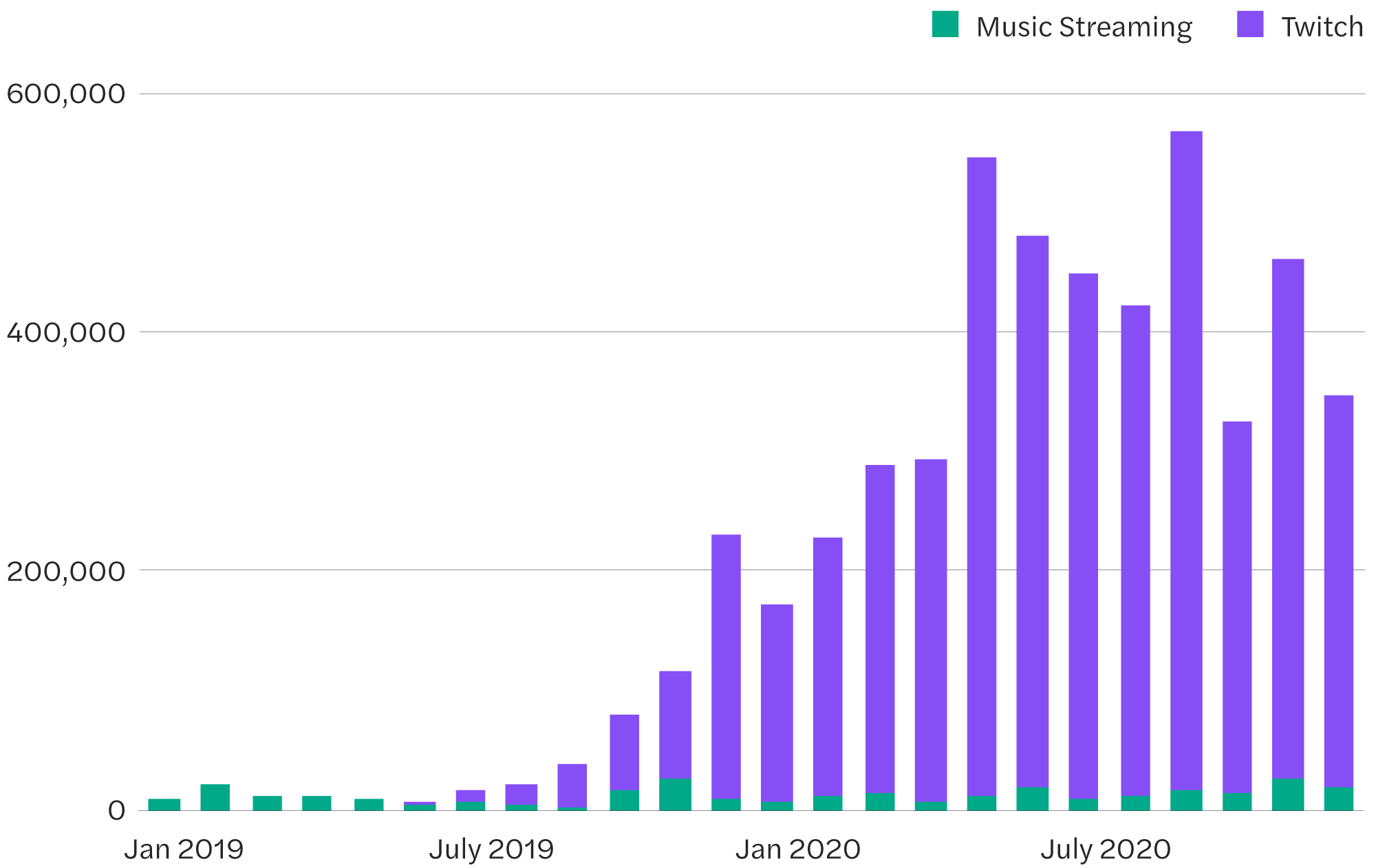

Grammy-winning music producer RAC began 2020 ready to embark on a huge nationwide tour to promote his record, BOY. As lockdown kicked in, the tour was kicked out and he turned to Twitch to connect with fans.

RAC’s Twitter account makes his DIY intentions clear, embracing all the new income-generating tools for independent musicians like Patreon. He’s also set up his own label and publishing company and has installed an incredible multi-camera setup showcasing all his gear, workflow, and cats! RAC’s not shy in celebrating (and Tweeting) his success on Twitch, and in a real sign of the times, RAC’s manager said he made more money via Twitch and Patreon in 2020 than he was expected to make on his nationwide tour.

MRC Data has a unique market position in that they aggregate not just US data but global too. This is long overdue; as streaming breaks down borders, we need global data to measure against a global audience. MRC Data doesn’t just twitch the curtain, it draws it wide open. We can put this to work by illustrating RAC’s active audience on Twitch and streaming platforms in the US (in the thick green and purple bars) and then plot his US share of global audience (in the dotted green and purple lines).

RAC peaked on streaming in May with an audience of over one million in the US, then peaked soon after on Twitch with over half a million (the numbers tapered off as he was breaking free from his label). The US made up around half of his audience on streaming, but two-thirds on Twitch – indicative of its US-dominated user base, as well as less obvious factors like time zones, as RAC was live streaming in the Pacific Time Zone when most European fans were fast asleep.

Active Audience, US

Closing Remarks—

Three themes are clear.

First, if you can find your ‘true fans’ and get them to engage with you on Twitch, then you can burst through the streaming ceiling and potentially monetise them more effectively.

Second, the money made on Twitch is often without an opportunity cost – artists are often making money doing what they need to do anyway: writing and rehearsing songs.

Third, Twitch is additive, not cannibalistic – increased engagement on Twitch correlates with more engagement elsewhere. It adds to the audience reach, not taketh away.

This all takes us back to the original inspiration for this inquiry: Kevin Kelley’s 2008 essay One Thousand True Fans. Sure, you may have a lot of fans, but only some of them are true; getting them to engage with you on Twitch as subscribers to your channel can make earning $25,000 per year a practical reality. Using the aforementioned ‘fifth of a fifth’ rule, a band of four (plus a manager) on a royalty of 20% and a global per stream of $0.003 would need over 210m streams to achieve this level of income.

That’s not to dismiss what can be achieved on global streaming platforms, but rather to point out where on the classic ‘Long Tail’ chart Twitch is competing. Twitch isn’t focused on the blockbusters in the head of the distribution, or the DIY artists down in the tail – but those in the ‘body’; or, in the parlance of Li Jin’s HBR article, Twitch is focused on fostering a middle class. And it’s what happens next that this inquiry has teed up, as the world begins to see light at the end of the pandemic tunnel.

It’s clear that all these advancements in live streaming will not go away when live music returns. The question is: how will they co-exist? Live streaming brings a completely different set of economics from touring; from the obvious of not having the same upfront and marginal costs to the more subtle, like discovering audiences in cities you wouldn’t have toured in and removing the need to add extra shows to accommodate higher than expected demand. Ralph Simon, a personal mentor, once remarked that ‘this business is about what’s coming next. It always has been’.

Live streaming is here to stay and this report has shown how it can pay. What comes next is how the economics uncovered here interact with the return of touring. How much of the change that Covid has brought sticks? As lockdown lifts, the music industry needs to figure out how to engage with fans in the post-pandemic world. We’re all in uncharted waters right now but, by establishing the rockonomics of Twitch, the music industry is better positioned to leverage a ‘first mover advantage’ and maximise the reach and revenue of whatever comes next. ❒

Partners

Acknowledgements

The author would like to thank Sara Clemens, Tracy Patrick Chan, Samantha Faught and Joel Wade at Twitch; Ally Glerum at MRC Data; Mark Mulligan at MiDIA and Chaz Jenkins at Chart Metric who provided data, insight and guidance. He would also like to thank Tom Frederikse (Clintons) and Sam Blake (Dot.LA) who helped draft the report. Finally, he would like to acknowledge the helpful comments from David Safir, Ralph Simon (Mobillium), Alice Clarke (A&C Studio Design), Rob McDermott, Seth Gerson (Survios), Yoshio Osaki (IDG Consulting) and especially Chris Deering.

A big thank you also goes out to all the artists who agreed to be featured in this report – Laura Shigihara, Aeseaes, Sereda, Matt Heafy, mxmtoon and RAC – for your approval and transparency. Your contribution to this report will help other artists attempting to navigate the world of live streaming, whether that is on Twitch or elsewhere.

Tarzan Economics

Eight Principles for Pivoting through Disruption

After a twenty-year head start of studying the rise, fall, and resurgence of the music business, Spotify’s chief economist shares the lessons he’s learned on how to recognize and adapt to disruption facing individuals, industries, and institutions.