One of the longest studies on human happiness started in 1938 and followed the lives of 268 Harvard sophomores. Known as the Harvard Study of Adult Development, it tracked everything about these men over decades. Their health, their careers, their relationships, and much more were recorded for the study. And after analyzing the lifetimes of data, the researchers came to a surprising conclusion:

Close relationships, more than money or fame, are what keep people happy throughout their lives.

Though many of these men had privileged backgrounds and very successful careers (one was even President of the United States), the researchers found that the quality of one’s relationships was more predictive of happiness than any other factor. In fact, according to Robert Waldinger, the director of the study, relationship quality was a better predictor of health than many traditional health markers. As he stated in his TED Talk on the same topic:

When we gathered together everything we knew about them about at age 50, it wasn’t their middle-age cholesterol levels that predicted how they were going to grow old. It was how satisfied they were in their relationships. The people who were the most satisfied in their relationships at age 50 were the healthiest at age 80.

This research sheds light on the importance of relationships for living a happy and health life. And while those in the Harvard study were all mostly privileged men, other researchers have come to similar conclusions about people in general.

I’ve been thinking about this a lot over the past week while spending time with my family in California (where I grew up). Every time I come home I’m always reminded of what I have to give up by living nearly 3,000 miles away in New York City. All the missed celebrations. All the foregone weekend events. All the lost time with my parents and grandparents.

And the question I always ask myself is: would I be happier if I lived in California instead of NYC?

And while in the past I could justify living in the Big Apple for my job, COVID has shown me that you don’t have to live here to have a career in finance. Yet, despite the terrible weather, the exorbitant rent, and the possibility of being randomly attacked by a man with a hatchet, I still choose to live in New York. But why?

As I’ve thought about it more, it’s because of how my non-family relationships would suffer if I left the city. As someone who lived in three different cities throughout my 20s (SF, Boston, and NYC), I’ve seen what it’s like to move and lose so many connections. People I used to interact with daily became an occasional text message or call. And some dropped out of my life altogether.

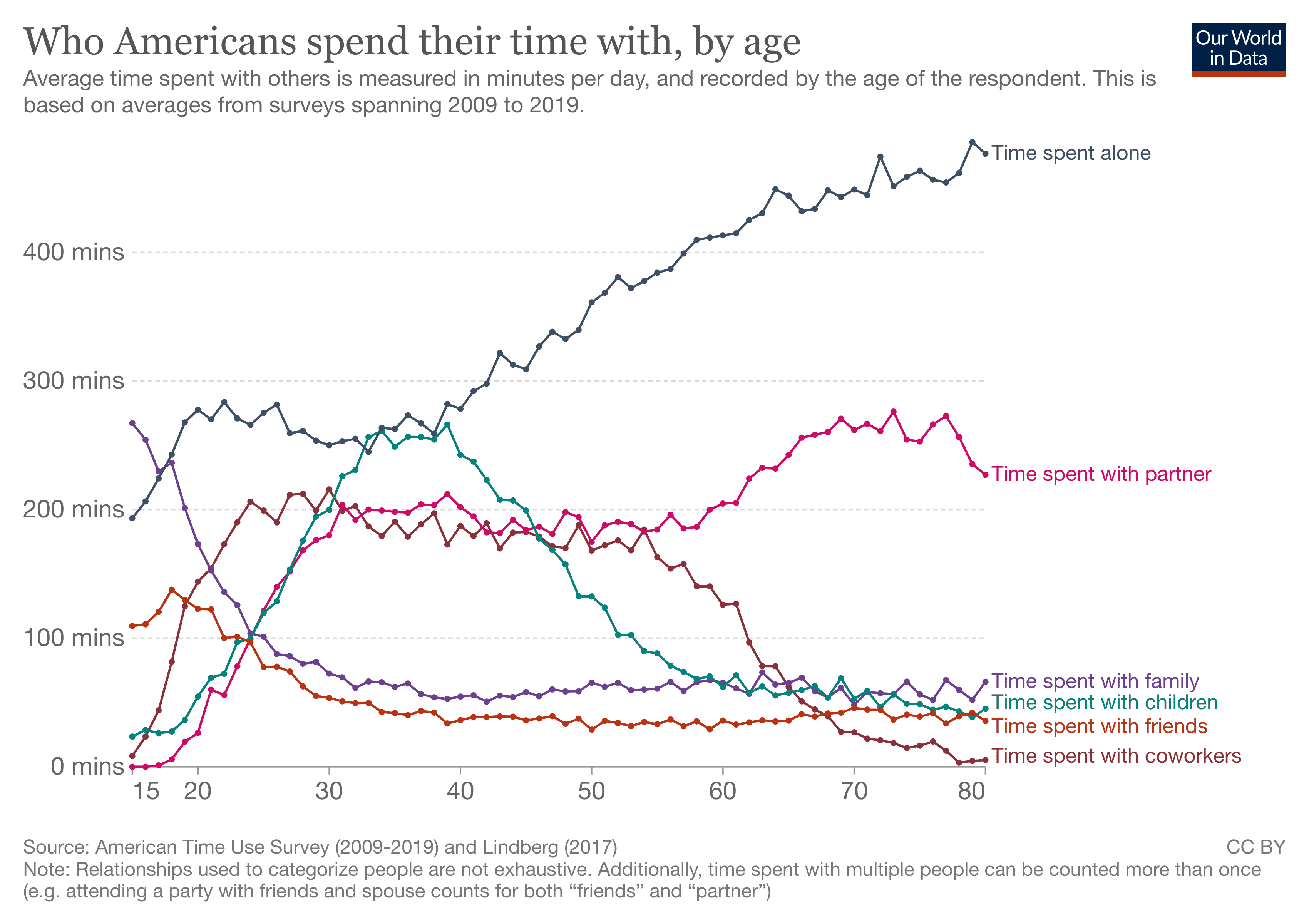

This is to be expected with age, but moving makes it worse. And if you look at how we spend our time over the course of our lives, you can see that time spent with our friends starts to decline in our 20s and bottoms out in our 50s:

This chart honestly terrifies me. Seeing friends slowly move out of your life as you start to spend more time alone is heartbreaking to say the least. This is probably your future as much as it is mine. But, I’m trying to avoid (or delay) this future as much as possible. I believe living in NYC gives me the best chance of doing so.

Because while many people in my network may never visit Boston and other cities in America just to see me, most will eventually pass through New York City. And guess what? When they do they usually contact me. I’ve only noticed this since living in NYC over the past few years, but it’s a perk unlike any other. It’s like a magnet for my more distant friends that keeps my social circle alive and well.

Before they visit they think, “Doesn’t Nick live in NYC?”

Yes I do. Send the text. Come through.

Because I live in a place frequented by so many, I am able to keep in touch with my friends in the Bay Area, Boston, and elsewhere when they inevitably visit. People who I may not have spoken to in years may drop me a line to hang out. And all it takes is these infrequent, in-person meetings to maintain a relationship with someone. Yes video calls are nice, but they can’t replace seeing someone in real life.

This is why I will happily pay some of the most expensive rent in the country to live in a place with weather that I (mostly) cannot stand. It’s a decision that will cost me financially in a big way, but I’m okay with that. Because what really makes people happy isn’t nicer weather or having a little bit more money, but more vibrant relationships. And I’m placing my bets accordingly. You should too.

Of course, this doesn’t imply that you (or anyone else) needs to live in NYC to be happy. But it does imply that you should spend more time working on your relationships. Because if you want to live a happier, healthier life, then you should focus on maximizing your social wealth instead of your financial wealth. If that means living closer to your friends or family, then do it.

Most won’t get this message. They will move to another state to save a marginal amount on taxes or live further away to get a slightly bigger house. They save money now, but pay for it later. They pay for it with more strained social connections, some which will eventually fade away.

If you think investing is just about dollars and cents, than you haven’t been paying attention. Sometimes the best investments are those you have to work for day in and day out. They are those that you can’t really put a price on.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 258. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data