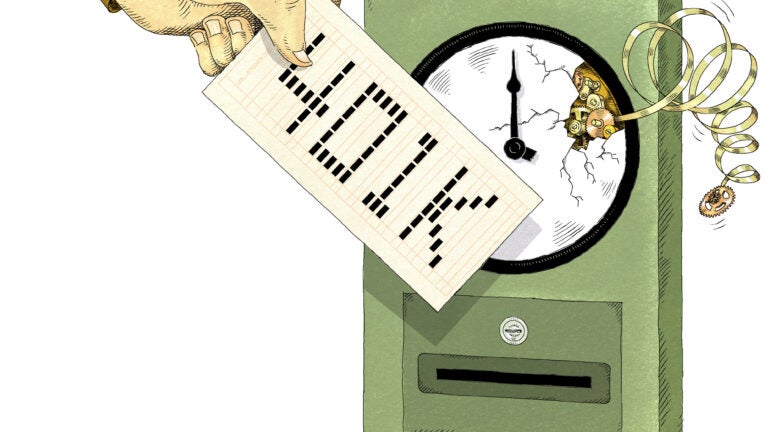

Waiting periods on 401(k) plans can be costly for workers

Many companies impose waiting periods of six months or more to join 401(k) plans – and those delays can end up costing workers tens of thousands of dollars in retirement savings.

At 33 years old, Nimesh Trivedi owns a home and is saving money with his wife for their children’s education. But investing for retirement had not been a priority.

That changed when Trivedi recently took a job at Massachusetts Mutual Life Insurance Co. in Springfield, where colleagues encouraged him to join the company’s 401(k) retirement plan right away. Trivedi’s last employer had a waiting period to join the retirement program, and eventually he just forgot about it.

Now that he has access to an attractive plan — available on day one, with a generous match from the company — Trivedi wishes the opportunity had come sooner. “We missed out on so much,’’ he said.

Nearly half of US companies impose a waiting period before employees are permitted to join their 401(k) plans. Most often the delay is six months, although it can be twice as long. At a time when workers are facing more pressure than ever to save for retirement, waiting periods are making the task harder, and reducing employees’ potential nest eggs by tens of thousands of dollars.

One trouble with waiting periods — as Trivedi’s situation shows — is that they keep some people from ever signing up for the plan. And in all cases, the gaps add up. If a worker changed jobs seven or eight times over the course of a career, “you could conceivably miss every upswing in the market,’’ said Mercer Bullard, a professor of securities law at the University of Mississippi, and founder of Fund Democracy, a mutual-fund watchdog organization. “It’s a real double whammy.’’

As traditional pensions vanish and uncertainty mounts about the future of Social Security, advocates for retirement savings see participating in a 401(k) plan as a necessity, not a privilege or perk.

Waiting periods affect workers across the economic spectrum. They are often most pronounced for lower-wage earners, who are likely to change jobs frequently, and prevalent at smaller companies, including high-tech start-ups.

These waiting periods can cost a typical worker tens of thousands of dollars over the course of a career, according to Brigitte C. Madrian

, a professor at Harvard University’s Kennedy School of Government who has studied retirement issues, and calculated the impact of delayed retirement savings for the Globe.

Take a person making $40,000 at age 35 and investing about 6 percent of his pay until age 65. Making some assumptions about raises and investment returns, that worker would save about $753,082, Madrian said. Now if that same worker changed jobs six times and had to sit out the first six months before investing at each new job, he’d have $670,173, or nearly $83,000 less.

And that’s a relatively conservative calculation. According to the US Department of Labor, the youngest baby boomers held 10 jobs just from age 25 to 46. By Madrian’s math, if the $40,000 earner changed jobs every 3.5 years and missed out on periods of saving for retirement each time, he would have $114,000 less at retirement — a 15 percent drop.

Employers defend waiting periods. They say that maintaining accounts for workers with small savings in high-turnover career fields can leave them with an administrative burden when people leave. A 2011 industry study estimated that companies on average paid $248 per person in 401(k) administrative costs. The costs can be higher at smaller companies, discouraging some from offering retirement plans..

At large companies, where 401(k) plans are generally expected, the waiting period is less prevalent and benefits tend to be generous. At MassMutual, EMC Corp., and Biogen Idec Inc., for instance, employees can join the retirement plans immediately and start receiving matching contributions right away. At Fidelity Investments, employees can start putting their own money into a 401(k) immediately, and a year later become eligible for a 7 percent company match.

Those matching contributions are a big motivator for many employees. Failing to enroll in the plan literally means leaving cash on the table. Biogen, the Cambridge biotech company, doubles the first 3 percent of pay each worker contributes, vesting immediately. MassMutual sets aside a 5 percent match starting on day one, but employees have to stay for three years to see those funds in their account.

Richard Goldstein, MassMutual’s vice president of benefits, said having a competitive 401(k) plan helps attract and retain employees, especially in financial services. The company has 91 percent of its workers enrolled in the plan, compared with an average of 67 percent across the customer base of Fidelity, the nation’s largest 401(k) provider.

“People are being held more accountable for their own financial lives, and our employees are no different,’’ Goldstein said. “We want them to have a secure financial future.’’

But in a time of corporate thriftiness, even some big firms see the 401(k) as an area where they can save money. Some cut matching contributions during the recession, although many of them have since restored those payments. IBM Corp. recently caused a stir when it decided to pay 401(k) matches annually, instead of with each paycheck. That lets the company hang on to its money longer, and means employees don’t get the benefit of regular investments that smooth the ups and downs of financial markets.

At some companies, different levels of workers get different benefits. For example, at Bank of New York Mellon Corp., salaried workers can join the 401(k) plan immediately. If they forget, they are automatically enrolled, with 2 percent of their pretax pay going to the program, unless they opt out. They are eligible for matching payments up to 5 percent of their pay.

But hourly employees at the New York banking and investment firm have a different deal: They must work 1,000 hours, the equivalent of six months, before they can sign up.

Joseph F. Ailinger, Jr., a spokesman for BNY Mellon, said the difference in plans was due to “high turnover for hourly employees, and the fact the participation rate is typically low for that group.’’

Harvard’s Madrian said she would like to see all employers offer retirement plans — without waiting periods.

She urged senators at a recent hearing in Washington to simplify 401(k) rules, and provide modest tax incentives to get more employers to offer plans or matching contributions.

Workers also need to think ahead, said Madrian. At Boston Human Capital Partners, a Woburn recruiting firm, chief executive Kate Morgan said some workers in small firms and the high-tech world seem willing to trade retirement benefits for nearer-term perks for a time.

“When we say they’ll get a 401(k) plan, we don’t get much reaction,’’ Morgan said, compared with employers paying 100 percent of health care or offering the chance to work from home.

Such trade-offs might seem tempting, said Madrian, but will be expensive in the long run.

“Retirement saving doesn’t have that same immediate urgency,’’ she said, “even though the long-term consequences could be important.’’

Conversation

This discussion has ended. Please join elsewhere on Boston.com