If you only have 2 minutes to spare, here’s what investors, operators, and founders can learn from Sushi’s story.

- Strong communities compensate for other weaknesses. While Sushi may not have the world’s most powerful exchange, it does have crypto’s most vibrant community. That’s driven its success in spite of its vulnerabilities.

- Crypto follows different paths for disruption. To unseat an incumbent in the crypto world, find ways to liberate power or wealth. Holding too tightly to either presents an avenue of attack for insurgents.

- Modern brand building must consider mimetic power. Though little thought seems to have gone into it, Sushi succeeded in landing on a meme and emoji-friendly brand. More consumer-facing companies should consider how their offering channels current forms of expression.

- Crypto is a multipolar market. Though global in scale, crypto nevertheless has power centers. In particular, North America and Asia represent the sector’s two poles; those with universal ambitions must be sure they’re taking into account both userbases.

Chef Nomi was in the wind. And he’d taken the money with him.

Just ten days after founding Sushiswap (aka Sushi), the decentralized exchange’s pseudonymous founder pulled out $14 million worth of Ethereum and disappeared.

What followed was the crescendo of 2020’s crypto bull-run and in particular, the torrid months known as “DeFi Summer.” Part manhunt, part trial by media, and part murder, the demise of Chef Nomi proved the beginning for something much more consequential: a truly decentralized organization, with a stronger community than any of its peers. That Sushi has succeeded not in spite of, but because of its chaotic origins illuminates what matters when it comes to empire-building in the crypto economy.

In today’s briefing, we’ll unfurl the full saga, before alighting on Sushi’s current scale, and future plans. We’ll touch on:

- The mark. Uniswap’s remarkable innovation, and critical vulnerabilities.

- The plan. How and why Sushi was founded.

- The heist. Chef Nomi’s ingenious maneuver to bring liquidity to the new exchange.

- The murder. A founder on the lam, and how DAOs mete out justice.

- The aftermath. The establishment of a headless organization.

- The future. Where does Sushi go from here?

Let’s...roll.

The Mark

It started with disappointment:

I just got laid off :(

In early July of 2017, a young mechanical engineer named Hayden Adams was fired from his role at Siemens. It was his first job since graduating from Stony Brook and must have seemed like a safe place to kick off a budding technical career.

Suddenly unemployed, Adams sent the text above to Karl Floersch, a friend embedded in the Ethereum ecosystem. Floersch responded:

Congratulations, this is the best thing that could have happened to you!!! Mechanical Engineering is a dying field. Ethereum is the future and you’re still early. Your new destiny is to write smart contracts!

Adams’ reaction illustrated the young man’s inexperience:

Don’t I need to like know how to code?

Floersch assured him it didn’t matter; Adams could learn whatever he needed to make a dent. Even he must have been surprised by the success of Adams’ first project.

Fifteen months after sending that dejected text to Floersch, Adams launched Uniswap, a decentralized, automated token exchange built on Ethereum. Simply reaching that point represented a feat of endurance and ingenuity; Adams had learned to program in multiple languages and forfeited a salary to turn what started as a hobbyist project into a full-featured decentralized exchange (DEX).

The significance of Adams’ innovation should not be underestimated. In creating Uniswap, he and the team succeeded in solving a bête noire of the crypto world: running an exchange without an order book. While the details are eye-glazing for all but the most fastidious of students, the upshot was that Uniswap was able to attract liquidity without centralization. No one had managed this before, at least not with the same elegance.

So, how did Uniswap do it?

It depends on who you ask. Some have suggested that Uniswap was a fork, with its v1 borrowing from rival project, Bancor. Adams has vociferously denied that claim:

Perhaps only those present at Unicorn HQ on day one know the truth of the matter.

What’s undisputed is that Adams successfully incentivized external parties to offer trading depth. “Liquidity providers” (LPs) deposit tokens into a pool and are rewarded as a result. For example, if I added ETH and USDT to the ETH-USDT pool, I could earn “liquidity tokens” by doing so, proportional to my contribution. (This is not the same thing as a governance token, which we’ll discuss in a moment.)

There’s further complexity in how “Automated Market Makers” (AMMs) like Uniswap manage the process, but this captures the salient points.

Uniswap’s novelty and early success did not go unnoticed by the capital class. Paradigm led a $1.8 million seed round into the project in 2019. By the next summer, Adams announced further capitalization with a16z leading an $11 million investment. By that point, Adams’ creation boasted roughly $130 million in Total Value Locked (TVL), a reflection of the amount secured via smart contracts. (Though not directly analogous, one way to think of TVL is as “assets under management.”)

While the interest of leading VCs validated Uniswap’s initial traction and long-term vision, it also created a vulnerability.

The Plan

It’s here that we should talk about the particular patterns of disruption in the blockchain world. Specifically, there seem to be two axial rules that govern the sector and offer openings to insurgents:

- The Law of Fluid Power. Crypto operates antithetically to extant power structures, seeing traditional hierarchies as unearned and illegitimate. This can relate to long-surviving institutions like the traditional financial system or newer companies like Coinbase. In both cases, power is perceived to have been captured by a central entity that seeks to codify and strengthen its grip. Crypto wants power to be perfectly fluid, accruing to contributors according to their value to the community. In this respect, it’s not only about decentralization — a perfect distribution of power is often not desirable — but relative merit within a decentralized structure.

- The Law of Fluid Wealth. Similarly, the crypto world is skeptical of rent-seeking entities. Organizations that do not provide continuous value and effort, earning under the same rules as every other participant, are often considered compromised. Crypto wants wealth to be fluid, rewarding sustained value creation. Radically, crypto considers users to be essential parts of the value creation rather than consumers of it.

This final point is best captured by a16z partner, Chris Dixon, in this Twitter thread:

Dixon articulates how web3 — the term used to describe a crypto-native internet — can win by redistributing take rates. Rather than keeping this fee as a centralized entity would, decentralizers often give it back to users, in recognition of their value.

Uniswap capitalized on this second law in rising to prominence. Coinbase, Binance, and other centralized exchanges not only served as the focal point for much of the crypto market but skimmed fees. While Uniswap also takes a fee, it passes it down to LPs, rewarding their contribution.

Though an upgrade, Uniswap soon learned that relative inattention to the Law of Fluid Power presented an issue.

By taking venture money, Uniswap effectively allowed for some of its platform’s power to be captured by interlopers. Much of this may have been simply a matter of perception — funds like Paradigm are renowned for adding tangible value to projects. Head of Research Dan Robinson was an earlier helper of Uniswap.

But to certain external parties, Uniswap suddenly appeared allied with the establishment. And while some ire may have been over-egged, the financing decision did carry a tangible impact. LPs that had helped get the exchange off the ground by seeding different markets risked their share of rewards being diluted by these much larger firms pouring money into the AMM.

Perhaps a greater violation of Law 1 was Uniswap’s governance structure. While the project did give LPs a way to earn, it did not give them a way to vote. There was no “UNI” token that offered the community a mechanism to voice their opinions and chart a path forward. Power was cloistered, captured by a select few.

That presented an avenue for attack, noticed by more than one commentator. On August 23, 2020, Director of Researcher at The Block, Larry Cermak tweeted the following:

Cermak posed an intriguing question: what would happen if someone took the power of Uniswap’s AMM, but added a token? What if the community owned 90% of the project and could determine its future?

Perhaps without realizing it, Cermak had outlined an ambush. One lurker was listening closely.

The Heist

Little was known about the person that referred to themselves as Chef Nomi.

Borrowing their pseudonym from Warcraft-inspired game, Hearthstone, Nomi appeared on Twitter just one day after Cermak’s tweet:

Even this initial iteration showed an appreciation of modern branding. Nomi chose a playful, endearing name that succeeded in being distinct, mimetically alluring, and extensible. That Sushi’s name has stuck and informed the nomenclature of all subsequent product launches speaks to that fact. (Aside: I wonder how commonly branding agencies consider emoji availability during their consultation process.)

While few noticed that first tweet, it didn’t take long for Nomi to attract attention. Two days later on August 26, Nomi officially announced the creation of Sushiswap. In a thread and Medium post, he outlined how Sushi differed from the project it had forked. That set in motion a series of events that occurred in such rapid succession, it’s worth previewing them:

In its opening post, Sushi noted that while Uniswap distributed its 0.3% in trading fees to LPs, this only applied to active providers. That meant that if you stopped providing ETH and USDT to, you ceased receiving rewards.

Sushi suggested such an arrangement was unfair since it failed to recognize the LPs that had gotten a project off-the-ground. To remedy that, Sushi took a 0.25% fee which it passed to LPs, with a further 0.05% given to holders of its token: SUSHI. Critically, SUSHI not only delivered continuous earnings — something Uniswap didn’t — but offered governance rights. From day one, the community would have the power to inform the project’s direction. Nomi had found the flaw in Uniswap’s power structure and exploited it. But he wasn’t done yet.

It takes a special mix of boldness and shamelessness to so blithely copy an existing product. While that can prove a superpower, as mentioned in our discussion of Rocket Internet, Nomi illustrated a particularly ruthless streak in the method that brought liquidity to Sushi.

Alternately called a “vampire attack” or “zombie mining,” Sushi’s attainment of liquidity relied on siphoning it from Uniswap; a heist in slow motion. Sushi managed this by offering rewards to Uniswap LPs. In exchange for providing their liquidity to 12 Sushi pools on Uniswap, LPs earned SUSHI (the token), with 2x the rewards for providing liquidity to the ETH-SUSHI market. Nomi outlined that after 15 days, this liquidity would move off Uniswap’s platform and onto Sushi’s own exchange.

Confused? Don’t worry.

This is convoluted stuff, particularly to those of us trying to wrap our heads around this movement. To try and make sense of it, here’s my best attempt at an Ocean’s Eleven-style walkthrough montage.

Our target: The Uniswap Hotel and Casino (TUHC)

As everyone knows, TUHC is one of the most attractive venues on The Strip, known for its good vibes and unusual gambling products. Everyone also knows that the magic behind TUHC’s operation is their “How to Run a Casino” playbook. The bad news? It’s locked in a vault. The good news? TUHC shares the passcode online for everyone to see!

After snagging the passcode, all we have to do is walk up the vault, type it in, and grab the playbook. Once we have that, we’ll know how to run our casino, Saloon of Ultimate Sushi (SUS).

Now comes the hard part: we have to convince TUHC’s bookies to come with us. Without them, we won’t have the money to offer the same kind of wild gambling as TUHC. So how do we do that?

First, we tell them to try it out. They don’t have to go anywhere yet — they can start by offering gambling pools inside TUHC. Think of it as our mini-casino within a casino. By switching allegiances, the bookies can earn more, even if they decide to stop backstopping bets. They can walk away, and still get paid.

Pretty good deal, right? But it gets even better.

We don’t want to just offer gambling within TUHC — we want to run our own place and turn SUS into the biggest casino on The Strip. By joining our gambling pools, when we open SUS in 15 days, they won’t just be bookies but actual shareholders. They’ll get to decide how the casino operates and help define its future.

And who knows what we’ll build together once we have our casino set up! A pool, a theater, a bank? We’re making a multiplex, and they’ll be getting in on the ground floor.

Sound like a plan?

This may not pass muster as a Hollywood treatment but there’s no doubting that Sushi’s vampire attack was high drama — not least because it worked.

Just three days after launch, Sushi had bled Uniswap of 53% of its liquidity; two days after that, it had reached 68%. Cermak tweeted “I’d be getting a little uneasy if I was Uniswap.”

Publicly at least, Hayden Adams was unfazed. On September 1, he posted a thread that began with an impassioned rebuke of Sushi:

Can't tell who is pretending and who legitimately doesn't understand that the $1B TVL deposited in an incredibly high risk investment on a single days notice is mostly massive whales

Anyone talking about community vs VC here is either delusional or intentionally misleading.

Though a large number of Sushi’s LPs did have significant holdings, Adams’ criticism didn’t tabulate with what was happening behind the scenes. Since opening up on August 26, Sushi’s Discord channel had attracted a steady flow of dedicated supporters, many from Asian markets. One entrant was “0xMaki,” an adherent that within minutes of joining the chat established himself as “General Manager.”

The same day that Adams expressed his skepticism of the Sushi project, it rose to the top of Defi Pulse’s rankings. In less than a week, it had become the largest project in the ecosystem by TVL.

Nomi’s heist seemed to have worked, attracting liquidity and galvanizing a movement that was gathering speed at breakneck pace. Sushi was the toast of the crypto world and all that was left was to complete the overture, migrating liquidity away from Uniswap. Everything was in hand. And then it fell apart.

Stay one step ahead of the most important trends shaping the future. Our work is designed to help you think better and capitalize on change.

The Murder

We have Freud to thank for the concept of the “founding murder.” In Totem and Taboo, the Austrian argued that culture solidifies in the aftermath of a symbolic parricide, father slain by the sons. That serves to release Oedipal anima and free the offspring.

René Girard embroidered Freud's concept. Rather than founding murders following an Oedipal construction, Girard believed such a killing could occur regardless of relationships between parties and came from the desire for groups to choose and punish a scapegoat. In an excellent piece on the subject, Alex Danco describes the phenomenon:

The idea in a nutshell is that any group or society that is stable over the long run probably owes its origin story to a distinct moment of shocking violence. The memory of that violence, at some subconscious level, helps to hold the community together. No one wants it to happen again.

The effect of the scapegoat bearing society’s sins is renewed unity and camaraderie; death begets vitality; violence precedes peace; to build Rome, one must first kill Remus.

It would give far too much credit to Sushi’s architect to imagine any of these thoughts visited him the night of September 4. Looking at the Discord, Chef Nomi seemed absorbed with the task of migration, answering a few questions, responding curtly when he did.

From the beginning, Sushi had carved out a “dev fund.” This sub-entity was allocated 10% of the project’s tokens as recompense for the effort of its developers. The idea was that those that brought Sushi to life and improved it would be rewarded. That included Chef Nomi. But while many converts to the platform knew of the fund, few appeared to foresee any issues. Nomi himself had proactively quelled concerns about absconding with funds, noting in the Discord that he was “a good guy”:

A couple of lines later he reiterated his position saying, “But seriously though. People that came here yesterday know how committed I am.”

The events of September 5 proved the emptiness of those words. The day before the planned migration, Nomi withdrew half of the dev fund’s SUSHI, selling it for 380,000 ETH. That amounted to roughly $14 million.

Nomi’s move was quickly branded as an “exit scam,” the practice of taking investor funds and disappearing with them. The Chef didn’t disappear though. Instead, he tried to fight his corner, justifying the decision by suggesting the withdrawal would give him more focus:

It made little difference. Crypto’s most powerful figures balked at the move, with Sam Bankman-Fried (SBF) tweeting “Chef Nomi sucks.” Worse, the community that had so organically formed around the project revolted, furious at the betrayal.

As with everything else related to Sushi, the fallout happened at a startling pace. The day after his escapade, amidst community pressure, Chef Nomi handed over the keys to the project to SBF. As the FTX CEO noted in Part One of our trilogy, it was a “time of need type of thing.” It was a critical decision. At a time when Sushi was all at sea, threatening to fully implode, SBF proved a safe pair of hands with the authority and respect to protect the project and usher it forward.

That stewardship was brought to a formal conclusion less than a week later. On September 9, Sushi finally migrated off of Uniswap, becoming its own exchange. The next day, SBF announced he had transferred the AMM’s keys over to a selection of new “chefs,” responsible for guiding the community going forward. That included Cermak, Robert Leshner of Compound, Matthew Graham of Sino Global, and the still pseudonymous 0xMaki.

And then, on September 11, the tale took a final surprising turn: Chef Nomi repented.

He also offered more than his contrition, returning all 380,000 ETH to the project.

It was a move appreciated by the Sushi community, recovering some degree of respect for its founder. But it didn’t matter — Chef Nomi had been murdered. Metaphorically, functionally, he had ceased to exist in the context of Sushi.

On September 12, he sent his last message in the Discord.

Referring to Nomi, one commenter wrote: “He’s gone xD.”

Another responded: “He’s still here. Been posting in the engineering channels. See #backend-dev.”

A moment later, the man himself appeared.

“In backend channel its me.”

That was the last he was heard of.

The Aftermath

It is a year to the day that Nomi vanished. That Sushi is still here at all is remarkable, a testament to the power of a “founding murder” to vitalize a community, a budding culture.

(Of course, as one commentator noted, it’s unlikely that Nomi is really gone. Rather he “lives among us, lurking in our Discords…it’s just that in a pseudonymous and decentralized protocol, nobody knows who he is.”)

In its first twelve months of operations, Sushi has succeeded, on many fronts. In particular, it has accrued the following:

- Large community. Sushi boasts roughly 200,000 users.

- Dedicated leadership. 0xMaki has stepped into the breach alongside Joseph Delong.

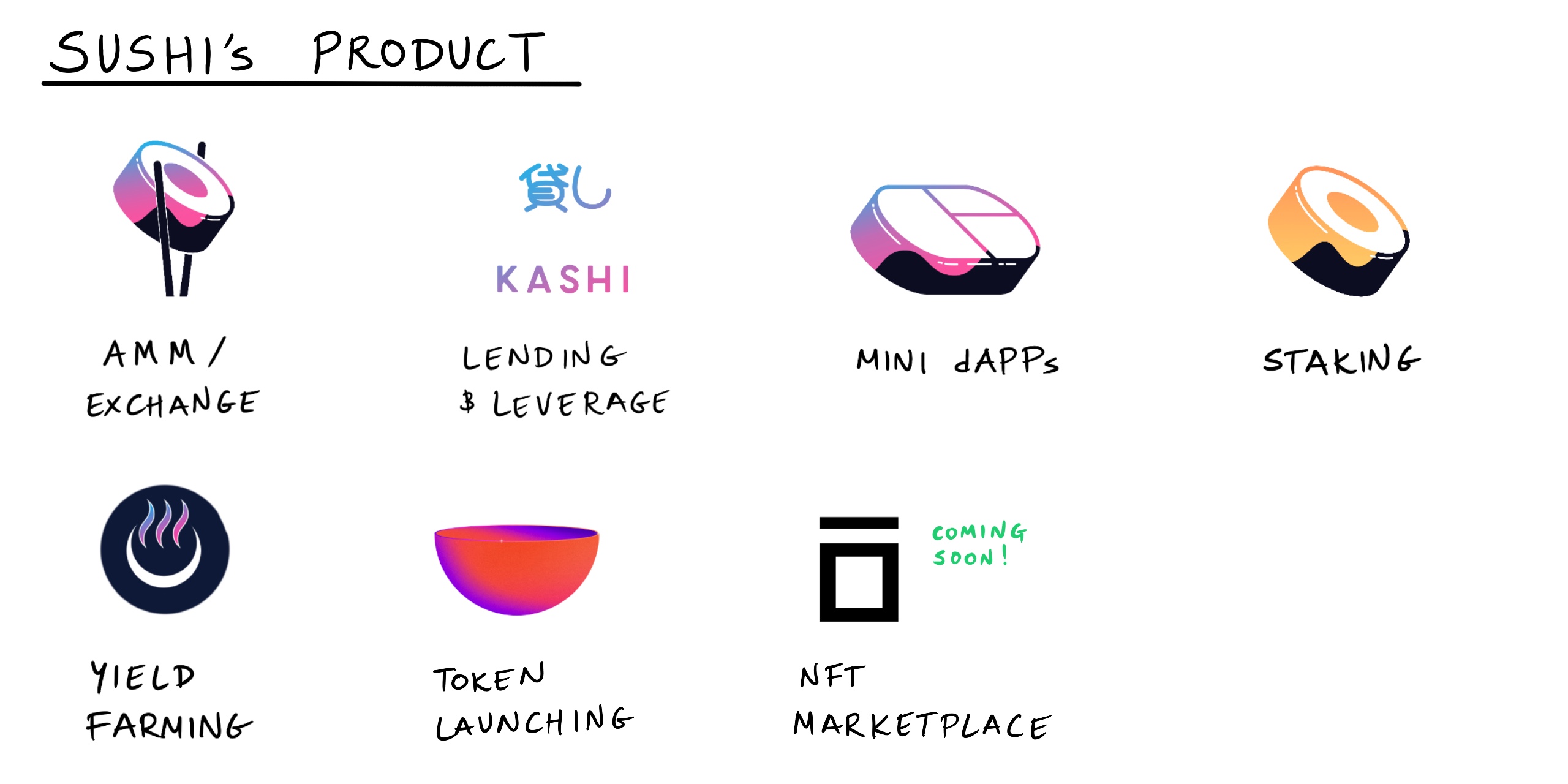

- Extensive product suite. Sushi spans lending, decentralized apps, and more.

- Considerable traction. Volume has grown, most recently sitting at $12 billion per week.

Despite that success, Sushi appears to be undervalued. Let’s take stock of where the project is today.

Community

In my conversations with crypto experts — who have all asked to remain anonymous or pseudonymous — the strength of Sushi’s community was mentioned most frequently. One source said:

Sushi is by far the largest and most interesting DAO to date. This is only possible because of its founding story IMO.

(Intriguingly, they added: “Loot could replicate, but it’s 6 days old, so we’ll see.”)

As noted, Sushi purportedly has about 200,000 users, with between 10,000 - 20,000 unique traders using the DEX each week. Its Discord boasts 45,000 members, of which ~15% were online during my period observing the community.

It is, genuinely, a pretty fun place to hang out. One morning, I spent an hour listening to Lofi music with other members. On other channels, largely friendly conversation continued unabated.

Given Sushi’s origins, comparisons to Uniswap, particularly on the subject of community, are unavoidable. Uniswap undoubtedly is larger with roughly 2.5 million users, 12.5x the size of Sushi. The DEX sees the same number of unique traders every day that Sushi hosts per week.

Its Discord sees similar engagement, hosting about 86,000 members, of which 11% were online during my exploration. (My haphazard logging of Discord activity should be seen as only the roughest of approximations; I would welcome better data.)

If these figures reveal anything about what separates the two communities it’s perhaps that of Sushi’s users, fully 22.5% can be found in its Discord; just 3.5% of Uniswap’s inhabit its equivalent chatroom. This is not a perfect analysis, of course, as Discord servers can be joined without proving token ownership, but it bolsters the impression of high-involvement sources emphasized.

This is also reflected in voting patterns. Looking at the last five proposals considered by the Sushi and Uniswap communities reveals a considerable difference in participation rates. Uniswap’s five proposals received a total of 1,641 votes, an average of 328 per motion. Despite being 8% of Uniswap’s size, Sushi received 5,283 votes for an average of 1057 over the same number.

You will recognize the coarseness of this comparison. Were these proposals really analogous? What if Sushi’s were all really important questions while Uniswap’s were trivial? How do we know these occurred over the same timespan? (Hint: they didn’t.) Nevertheless, they’re another data point that directionally reinforce source opinions.

A final note on the subject of community: one long-time crypto expert noted that Uniswap and Sushi’s communities differ in geographical make-up and tone. By dint of its founding team and early community, Uniswap has attracted a primarily North American base. According to this source, that provenance has contributed to what can feel like an exclusionary, elitist vibe. Sushi effectively counter-positioned against that sensibility, casting itself as the more inclusive, global AMM. That seems to have proven particularly attractive in Asian markets:

I don’t think the Uniswap team realizes just how much of a pedestal they put themselves on, and how poorly they engage the community, especially in Asia. They just gave it to Sushi without even realizing it, and still don’t.

Team

Of course, Sushi’s leadership is partially responsible for its more open vibe. Since Nomi’s departure, the project has relied on members stepping up, in particular, 0xMaki and Joseph Delong.

It’s worth saying that in one respect at least, Nomi may have been a loss. Fittingly, much of what I heard about him came in the form of second and third hand accounts. One person’s description felt almost like a shadowy whisper. They described him as an exceptional technical talent — a far cry from the crude imitator he was often cast as. That was about the only trait I could uncover. (There has been some doxing of Nomi, but let’s not go there.)

Nomi was not the only high-profile departure from Sushi during its first 12 months. One early community member noted that the project seemed to have two founders at inception. They pointed to a since-deleted user peppering early conversations:

Beyond the “Deleted User” illustrated above, another evangelist, “CTRL”, exited Sushi in its first year. CTRL initially served as a community manager, but left in dubious circumstances. In Discord, one user described the fallout:

If I recall it correctly he tried to blackmail the team and did almost nothing while being paid thousands.

Perhaps that’s why 0xMaki’s most valuable contribution may be a sincere commitment to the project. While others may have tried to make a fast-buck, Maki possesses a genuine enthusiasm for Sushi, making him an apt avatar for the community.

It's unclear whether that’s allied with the same technical talent Nomi possessed. In an interview with the Unchained podcast, Maki described himself as a crypto-outsider without the experience to be “taken seriously.” One source that has followed the DEX landscape validated that opinion. After hearing an early Maki interview, they considered him “totally clueless.”

That is not a universal view, of course. A different commentator characterized Maki as a skilled BD contributor and a talented recruiter. While the community ultimately signs off on bringing new parties aboard, Maki tapped major players like Keno and Joseph Delong.

(He was also responsible for the fat-fingered Discord message “tfars iuyt balitd,” a nonsensical sentence which became a Sushi rallying cry.)

Ultimately, the opinions I heard about Maki painted a conflicting picture, and despite digging through the community chat and interviews, it was hard to discern how, exactly, he fits into the Sushi project.

Joseph Delong presents a more straightforward profile. Prior to joining Sushi full-time, Delong worked as an engineer at crypto company Consensys, and served as a researcher at the USAA’s Blockchain Lab.

As well as bringing experience to the table, Delong is also Sushi’s more visible, vocal leader. While Maki appears to spend comparatively little time on the Discord, Delong is active, joking about new emoticons in one channel, getting connected with a new interested engineer in another.

Both Maki and Delong deserve credit for keeping the project running. But despite their best efforts, Sushi seems to operate in a state of chaos. That’s particularly evident when looking at Sushi’s product.

Product

From one vantage, there’s a great deal to be celebrated. In a short amount of time, Sushi has rolled out a broad suite that includes lending (“BentoBox”), yield farming, staking, and token launching tools (“Miso”). An NFT platform (“Shoyu”) is expected to debut soon, and will represent the first decentralized player in the space. That could be a big deal.

Even more impressively, many of these initiatives arose organically without outside incentivization. Both BentoBox and Miso were created by members before they were “hired” by the project to contribute more formally. This is what a truly headless organization looks like at its best — talented individuals spot an opportunity and use their skill to bring something valuable to life.

It’s also emblematic of Sushi’s lack of focus. What does Sushi want to become? Comparing Sushi’s scope to Uniswap is instructive:

While typically matrices like these are used to show where one company lags another from a feature perspective, it’s hard not to look at this through a different lens. Sure, Uniswap may not have Sushi’s range, but it has something arguably more important: direction. There’s an irony that a project named Sushi feels spiritually closer to a paella.

One source succinctly differentiated between the two projects’ strategies, stating that “Sushi is innovating on product and community engagement, while Uni is innovating on protocol.”

Time will tell which is the shrewder approach.

Traction

So far, Sushi’s jumbled product doesn’t seem to have held it back much. Judging by its traction — dangerous given the hyperventilation of the entire crypto sector over the past year — the project is thriving.

Though its days of threatening Uniswap’s supremacy are behind it, Sushi has established itself as the second-largest DEX by volume. Its 14.8% market share at the time of writing trails Uniswap’s 65.6%, but has remained fairly constant over the past seven months.

That share adds up to meaningful numbers. Sushi’s current fully-diluted market cap sits at $2.8 billion, up from $1.2 billion three months ago. Weekly volume hovers around $2 billion, with $4.3 billion of TVL at the time of writing, enough to make Sushi the ninth-largest Defi project by that measure. Uniswap is sixth, with $6.4 billion.

What once looked almost like a joke initiative has become a serious player.

Valuation

Arguably Sushi is undervalued relative to this traction. Compared to other DEXs, Sushi’s fully-diluted market cap looks discounted by TVL, volume, and revenue multiples.

Whereas Uniswap’s market cap is 13x its annualized revenue, for example, Sushi’s is just 9x. That’s a meaningful distance from the market leader, and a far cry from the multiples Curve, Pancake and Bancor have attracted. (The different offerings of each of these platforms makes perfect comparisons tricky, but it’s nevertheless illustrative.)

Were Sushi’s projected revenue to be valued at the same rate as Uniswap's, the project’s market cap would surpass $4.2 billion. It seems simultaneously true that Sushi has room to run but that the crypto market views it with some skepticism.

If Sushi wants to win over the doubters, and become more than just crypto’s most compelling case study, it will need to chart a clearer path forward.

Don't miss our next briefing. Our work is designed to help you understand the most important trends shaping the future, and to capitalize on change. Join 55,000 others today.

The Future

In a recent Twitter thread, Kyle Samani, founder of Multicoin Capital wrote:

I think Sushi is little bit lost, and doesn’t know what it wants to be when it grows up.

After a historic birth last year, Sushi seems to have sped through childhood, arriving at adolescence (and the accompanying identity crisis) in record time.

What should Sushi become? How can it leverage the most engaged community in crypto to fulfill its potential?

In speaking with experts, and through the course of my research, I’ve come to believe Sushi should consider three critical steps:

- Lean into Shoyu

- Improve the core

- Look beyond the consumer

While numbers 1 and 2 can be pursued in tandem, embarking on number 3 may require more information.

Lean into Shoyu

One of Sushi’s newest initiatives could prove the key to unlocking a second act.

Proposed just six months ago, decentralized NFT marketplace Shoyu is expected to launch a v1 in November. That represents a rapid turnaround for a significant addition to the platform.

There’s reason to think that while Sushi’s product already looks unwieldy, Shoyu could be beneficial. For starters, NFTs are having a moment. In August, market leader Open Sea recorded $3.4 billion in volume, a 1000% increase month over month. That is insane momentum, and meaningful volume.

Better yet, the competitive dynamics look favorable to Sushi. Open Sea is the dominant player by a large margin with Nifty Gateway, the second-largest exchange, recording less than $30 million in August. Shoyu might be able to pick off smaller competitors in a relatively short amount of time.

This may be particularly true given that incumbents (a descriptor that hardly fits companies in such a dynamic space) are centralized. If we believe that our Two Laws of Crypto Disruption extend into the NFT space, Sushi has clear avenues of attack. Open Sea, Nifty, SuperRare and others capture both power and wealth — Shoyu can free them.

Lastly, NFTs seem to work best when animated by community effervescence. If there’s one attribute that is unique to Sushi, this is it. With a dedicated tribe already in place, Shoyu could prove a natural outlet for the project’s creative energies, as well as a large source of income.

Though early, Shoyu seems like the kind of bet worth prioritizing.

Improve the core

In concert with supporting Shoyu, Sushi should upgrade its core product. This is critical to keep pace with Uniswap, avoid unforced errors, and prepare for the future.

One source I spoke to was definitive in the fact that Sushi lags Uniswap as an AMM. While Maki and Delong have presided over a great proliferation of the platform, Adams has focused on improving infrastructure. As Sushi maintains its multiple business units (and adds more), it must ensure that the deficit doesn’t increase. If it does, Sushi is likely to bleed share to Uniswap, jeopardizing its core business.

An upgrade could also help avoid costly liabilities. In mid-August, Sam Sun of Paradigm discovered a vulnerability in Sushi’s suite that left 109,000 ETH ($381 million) open to attack. Rather than exploiting it, Sun helped patch it up. Though impressive as a feat of expertise and altruism (especially given Paradigm’s investment in Uniswap), it illustrated that Sushi’s has fundamental work to do.

The final rationale for improving the core is that it positions Sushi to serve a different set of investors. On this subject, one source suggested that Sushi should focus on building out a stronger margining engine; taking a page from centralized exchanges like FTX. As part of that, the DEX could utilize other protocols including Perpetual, which offers “10x leverage to makers and takers.”

This could set the stage for derivatives trading, and institutional clients.

Look beyond the consumer

If there has been a unifying strategy to the product to date, it’s been a focus on serving the retail investor. In that mission, Sushi has become a kind of “super app,” albeit one with weaknesses.

It seems too early to abandon that focus, hence the prioritization of Shoyu. If Sushi can own decentralized NFTs, there may not be a need to shift its attention. But if Shoyu fails to gain momentum, Maki and Delong should quickly look elsewhere.

Assuming the team has upgraded the core infrastructure, Sushi should be well placed to embrace professional investors. That’s something Samani highlights in the thread cited earlier:

I don’t think the Sushi community has had a serious discussion about how the world evolves over the next few years, and where/how Sushi should position itself in that world. I think it’s a mistake to ignore the derivatives market. It’s just too big to ignore. And unlike spot trading, there is real lock in from derivatives (collateral cannot be removed without closing positions)… It is very possible that in order to do this, Sushi needs to split the front end in two: pro and retail.

Could this be Sushi’s next act? Could the platform become the decentralized go-to for serious derivatives traders? With Uniswap successfully grabbing a good portion of the retail market, it might make sense for Sushi to pursue an institutional clientele.

While each of these opportunities is compelling, above all, Sushi must hold on to what has made it special already. The community’s wisdom and potential cannot be underestimated.

Wherever they are, I believe that Satoshi dreams of Sushi.

In its very construction, the Uniswap-fork represents the clearest manifestation of decentralization and the remarkable power of crypto to forge connection and galvanize action. Though dramatic at the time, the founding murder of Chef Nomi ultimately fortified those early bonds.

As Sushi begins its second year, holders will hope it adheres to that spirit while demonstrating greater precision. If it can manage to balance both chaos and clarity, it may yet prove to be Defi’s killer dish.

_____

Thank you to Annika Lewis, David Phelps, and Zafa for their help with this piece.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Join over 55,000 curious minds.

Join 100,000+ readers and get powerful business analysis delivered straight to your inbox.

No spam. No noise. Unsubscribe any time.